RBizz Corporate Accountants are Melton’s top accountants, trusted by small businesses, companies, trusts, sole traders and individuals. With over 25 years of proven experience, our accounting firm delivers end-to-end solutions — from company tax returns, trust tax returns, SMSF tax returns and individual tax returns to company setup, family trust setup, SMSF setup, SMSF audit, business registration and ASIC compliance.

We also specialise in bookkeeping services, BAS, HR and payroll, nominee director and resident director appointments. Backed by a high-performing team of Chartered Accountants, tax agents, tax accountants, business advisors and virtual CFOs, and supported by advanced systems, we guarantee precise results, streamlined service, and unbeatable value — all under one fixed monthly fee. We are one Australia’s fastest growing accounting firm who offer services to clients in Australia and across the globe.

Why Choose RBizz Corporate Accountants in Melton?

With 25+ years of experience, award-winning service, and Chartered credentials, RBizz stands out as Melton’s go-to firm for expert financial insight and dependable accounting leadership.

Over 25 Years of Experience Across Australia

Fully Qualified Chartered Accountants

Tailored Packages for Startups, SMEs, and Global Clients

Transparent Fees with No Hidden Costs

Who We Are

RBizz Corporate Accountants is a modern, tech-savvy accounting firm delivering smart, tailored solutions in tax, advisory, payroll, and compliance — with client success as our top priority.

Regulated, Certified & Globally Affiliated

RBizz Corporate Accountants is governed by Australia’s top financial bodies and committed to the highest standards of compliance.

Awards & Recognition

RBizz Corporate Accountants is recognised for excellence in accounting, innovation, and client-focused service in Australia.

Our Valued Corporate Clients

RBizz Corporate Accountants is honoured to serve a diverse range of respected corporate partners.

Your Satisfaction is Our Guarantee

At RBizz Corporate Accountants, we don't compromise with customers satisfaction. We do everything in that direction only. We offer various types of guarantees and assurances for heightened confidence and total peace of mind of our valuable customers.

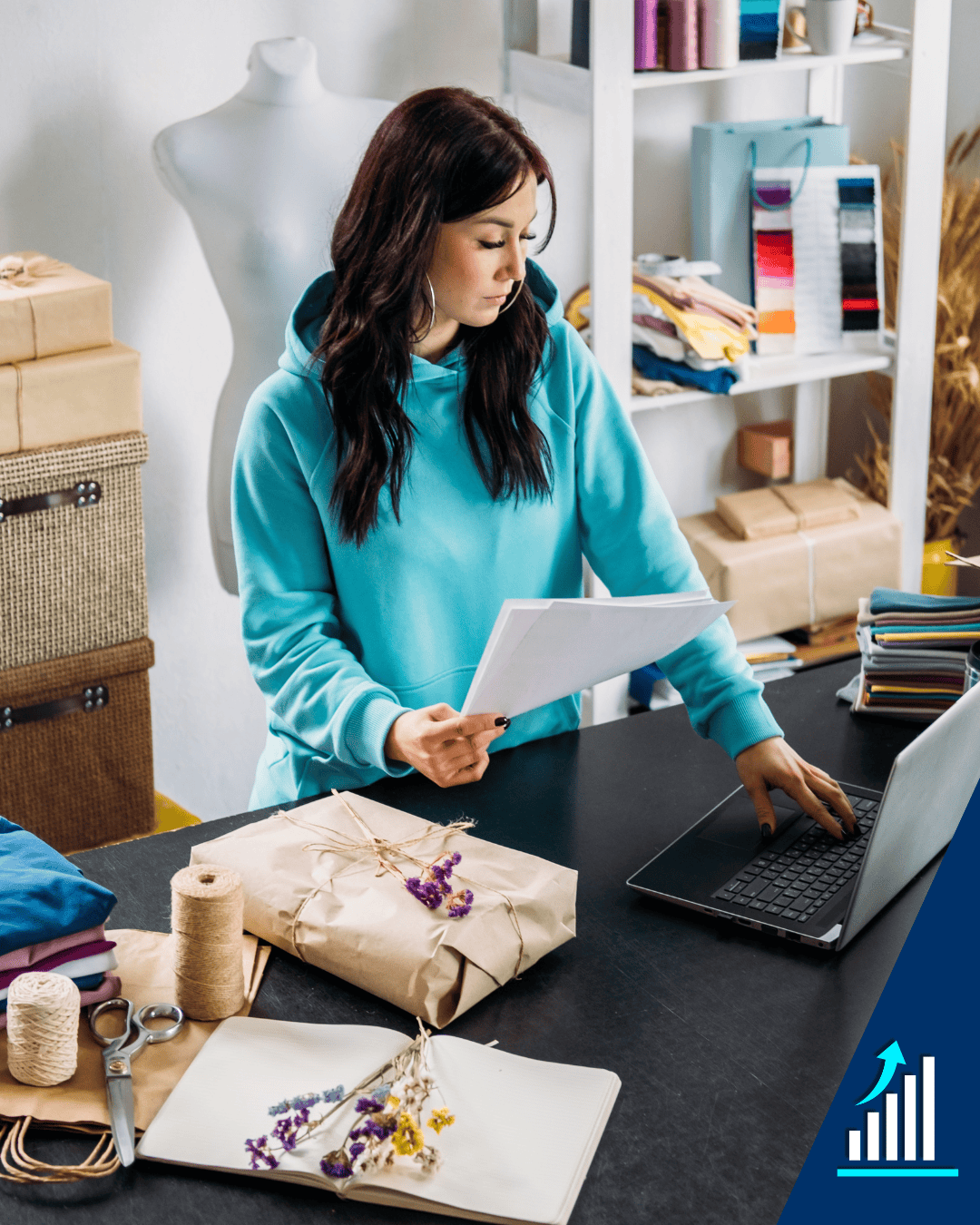

Who We Help in Melton

Whether you're just starting or scaling fast, our tailored solutions meet you where you are.

Small & Medium Businesses

Sole Traders & Partnerships

Startups & Tech Companies

Healthcare & Professional Services

Overseas Companies Expanding to Australia

Trusts, SMSFs, and Investors

Our Services for Clients in Melton

At RBizz Corporate Accountants, we provide strategic and dependable accounting services to help your business grow with confidence and clarity.

Accounting Services

Ideal for small businesses, sole traders, and companies.

Taxation Services

ATO-compliant returns, and year-round tax planning services.

Business Advisory & Strategy

Virtual CFO Services

CFO expertise without full-time hiring for growing companies.

Business Setups & Registrations

Ideal for local entrepreneurs and foreign companies in Australia.

Statutory & Corporate Compliance

End-to-end company compliance for entities.

Resident Director & Local Representation

Fully compliant with Australian residency requirements.

Payroll & HR Services

Perfect for companies with 1 to 100+ employees.

R&D Tax Incentives and Grants

Boost cash flow with government-backed incentives.

Accounting Services in Melton

Ideal for local entrepreneurs and foreign companies entering the Australian market.

At RBizz Corporate Accountants, we provide professional accounting services in Melton tailored to the needs of small businesses, startups, family groups, SMSFs, and growing companies. As a trusted accounting firm in Melton, our expert team of Chartered Accountants and Business Advisors deliver reliable, accurate, and timely reporting to help you make informed business decisions.

Whether you're looking for bookkeepers in Melton, need help with financial reporting, or want to streamline your processes using cloud accounting tools like Xero, MYOB, or QuickBooks, we’ve got you covered.

| Our Accounting Service Offerings

Select a service to see how we can help

Financial Accounting & Reporting

Timely and accurate financial statements tailored to your business.

Management Accounting

Make informed business decisions with meaningful internal reports.

Bookkeeping Services

Reliable day-to-day financial recordkeeping for local businesses.

Budgeting & Forecasting

Plan for the future with realistic budgets and data-driven forecasts.

Cash Flow Management

Ensure you have enough liquidity to cover your obligations.

Cost Accounting & Process Improvements

Analyze costs and enhance efficiency in your business operations.

Explore Our Services in Action

Watch Our Service Overview on YouTube

Access our free tools, tips, blogs, and videos to grow your business smarter.

Need Personalised Help?

Why RBizz is Melton’s Trusted Accounting Partner

Local Melton experts with deep knowledge of community business needs

Personalized accounting solutions tailored to your goals

Transparent fixed-fee packages for small businesses and individuals

Year-round support including proactive tax planning and advice

Trusted by local professionals, startups, and family-run businesses

We don’t just manage your numbers — we help you grow a financially healthy business.

Financial Accounting & Reporting

Gain complete visibility and control over your finances. Our Financial Accounting & Reporting service ensures your business stays compliant, financially healthy, and informed — with accurate reports you can trust.

What We Offer:

Comprehensive Financial Statements

Prepared in line with AASB, ready for banks, investors, or the ATO.

ATO & ASIC Compliance

Meet all reporting and regulatory requirements with ease.

Expert Guidance

Led by Chartered Accountants who understand your industry.

Ongoing Support

Get strategic insights and answers, not just reports.

Why It Matters?

Accurate financial reporting is the foundation of any smart business decision. It builds investor confidence, simplifies audits, and helps you identify strengths and risks early.

Management Accounting

Our management accounting services in Melton provide tailored monthly or quarterly reports to support decision-making, budgeting, and forecasting.

What We Offer:

Custom Monthly or Quarterly Reports

Tailored to your goals and KPIs, delivered on your schedule.

Budgeting & Forecasting Support

Build realistic plans and predict trends with confidence.

Actionable Insights

Get strategic analysis that drives smarter decisions.

Flexible Reporting Options

Choose the reporting depth and frequency that fits you best.

Why It Matters?

Regular management reports help you understand what’s working — and what’s not. With clear financial direction, you reduce guesswork, improve performance, and take control of your growth.

Bookkeeping Services

Our experienced bookkeepers in Melton manage your day-to-day transactions, reconciliations, accounts payable and receivable, and BAS preparation. Whether you're using Xero, MYOB, or QuickBooks, we’re here to help you save time, reduce errors, and keep your books accurate and ATO-compliant.

What We Offer:

Day-to-Day Transactions

We handle your daily sales, expenses, and journals with accuracy.

Accounts Payable & Receivable

Stay on top of bills and get paid faster with clear account tracking.

BAS Preparation

Timely, compliant Business Activity Statements done for you.

Xero, MYOB & QuickBooks

Certified experts ready to support your preferred cloud system.

Why It Matters?

Accurate bookkeeping is the backbone of financial health. It ensures you meet compliance deadlines, make informed decisions, and build trust with banks, investors, and the ATO — all while freeing up your time to focus on growing your business.

Budgeting and Forecasting

From startups to established businesses, we prepare accurate budgets and cash flow forecasts that help you plan for growth and stay on track.

What We Offer:

Cash Flow Forecasting

Understand future cash needs, avoid shortfalls, and prepare for big decisions.

Annual Budget Planning

We help you build realistic budgets aligned with your goals and seasonal trends.

Variance Analysis

Track performance against your budget to stay on target and adjust strategies.

Growth Scenario Planning

Test different scenarios and growth paths to make proactive, informed decisions.

Why It Matters?

Without a solid financial roadmap, businesses can quickly lose direction. Budgeting and forecasting not only keep your spending in check — they also empower you to seize opportunities, handle setbacks, and scale with confidence. Our insights give you the clarity and control you need to lead your business forward.

Cash Flow Management

Effective cash flow management is critical for business survival. We’ll monitor, analyse, and optimise your cash inflows and outflows so your business stays liquid and operational.

What We Offer:

Real-Time Monitoring

Track incoming and outgoing cash to stay on top of your financial health.

Cash Flow Forecasts

Predict future cash position to plan ahead and avoid liquidity issues.

Payment Strategy

Structure payables and receivables to maintain positive cash flow.

Expense Analysis

Identify unnecessary spending and improve cash efficiency.

Why It Matters?

Poor cash flow is one of the top reasons businesses fail. Even profitable companies can go under without steady cash management. With our expert insights and proactive strategies, you’ll gain visibility and control over your finances, avoid cash crunches, and operate with confidence — no matter the market conditions.

Cost Accounting & Process Improvements

We implement cost control measures and provide unit economics insights that empower your business to make data-driven decisions on pricing, production, and resource allocation. Our focus is on improving processes and maximizing profit margins.

What We Offer:

Cost Analysis

Break down fixed and variable costs to identify savings and inefficiencies.

Unit Economics

Understand per-unit cost and profit to guide pricing and product decisions.

Process Improvement

Streamline operations and reduce waste with targeted process analysis.

Cost Control Strategies

Implement smart cost-reduction methods without compromising value or quality.

Why It Matters?

Knowing your numbers isn’t enough — understanding where your costs come from and how to control them can be the difference between growth and stagnation. Through cost accounting and process improvement, your business gains clarity, efficiency, and competitive advantage.

Who We Serve in Melton

Our clients include:

Discover More About Accounting Services in Melton

Financial accounting focuses on producing reports for external users (e.g. ATO, banks), while management accounting helps business owners make operational decisions using internal reports like KPIs, budgets, and forecasts.

Ideally both. A bookkeeper keeps your records up to date daily/weekly, while an accountant prepares reports, provides insights, and ensures tax compliance. At RBizz, we provide end-to-end services so you don’t need to manage multiple providers.

Yes. We’re certified in Xero, MYOB, and QuickBooks. We’ll set up your cloud file, customise your chart of accounts, and provide training so you can use it confidently.

Absolutely. Many of our clients are tradies, sole traders, consultants, and e-commerce sellers. We offer cost-effective bookkeeping and accounting plans designed for smaller operators.

Our packages start from $150/month for bookkeeping and $220/month for full accounting services, depending on your size and needs. We’ll provide a fixed-fee proposal upfront.

Didn’t find what you’re looking for?

Taxation Services in Melton

ATO-compliant returns, year-round tax planning, and dispute resolution.

At RBizz Corporate Accountants, we offer comprehensive tax services in Melton designed to help individuals, businesses, family groups, and SMSFs meet their tax compliance obligations and reduce their tax liabilities through smart planning. As trusted tax agents and tax accountants in Melton, we’re here to simplify your tax affairs and help you navigate complex rules with confidence.

From individual tax returns to corporate tax planning, our Chartered Accountants combine deep technical knowledge with proactive strategies tailored to your needs.

| Tax Services We Offer

Select a service to see how we can help

Explore Our Services in Action

Watch Our Service Overview on YouTube

Access our free tools, tips, blogs, and videos to grow your business smarter.

Need Personalised Help?

Why RBizz is the Trusted Tax Partner in Melton

We don’t just lodge your tax return — we help you build a tax-efficient future.

Tax Returns Preparation

We ensure your returns are accurate, ATO-compliant, and lodged on time — helping you avoid penalties and maximise refunds or deductions.

Choose a taxation service below that best suits your needs:

Individual Tax Returns in Melton

Accurate, Fast & Stress-Free

At RBizz Corporate Accountants, we specialise in preparing and lodging individual tax returns in Melton for professionals, employees, sole traders, investors, and retirees. Our experienced tax agents in Melton ensure that you claim every allowable deduction while staying fully compliant with ATO regulations.

We make tax time simple — whether you have one PAYG summary or multiple income sources, we tailor your return to maximise your refund and avoid surprises.

Access our free tools, tips, blogs, and videos to grow your business smarter.

RBizz – Your Trusted Tax Partner in Melton

ATO-Registered Experts

Work with experienced tax agents registered with the Australian Taxation Office for accuracy and peace of mind.

Fast Turnaround

We value your time — get your tax returns done quickly and efficiently, often within 24–48 hours.

Secure & Confidential

Your privacy is our priority. We ensure all personal data is handled with strict confidentiality and care.

Friendly, No-Jargon Advice

We speak your language and make tax time simple — no confusing terms, just helpful support.

What You Need to Know

- Lodgement Deadline: 31 October (or later if using a registered tax agent)

- Common Inclusions: Salary & wages, interest, dividends, rental income, capital gains, government payments, foreign income

- Deductions may include:

- Work-related expenses (uniforms, tools, home office)

- DonationsSelf-education

- Travel (if work-related)

- Tax agent fees

Our Process - Individual Tax Return

Initial Consultation

Phone, Zoom, or in-person at no cost.

Document Submission

Upload via our secure portal or email.

Detailed Review

By our Chartered Accountants.

Maximise Refunds

Through all legal deductions.

Lodgement with ATO

Via our registered tax agent portal.

Post-Lodgement Follow-up

Including ATO assessment check.

Turnaround Time: Usually within 1–3 business days after receiving complete info.

How to Reduce Your Tax Legally

| Prepay deductible expenses (e.g. interest, subscriptions) before 30 June |

| Contribute to super (concessional limit applies) |

| Keep detailed receipts for work-related expenses |

| Use the logbook method for car claim |

| Offset capital gains with losses where possible |

| Declare only assessable income — we’ll help you identify what’s exempt |

Discover More About Individual Tax Return in Melton

Our individual tax return packages start at $220 incl. GST. Complex cases (multiple income sources, investments, capital gains) may vary slightly.

We can assist with multiple years, avoid penalties, and even help set up payment plans with the ATO if needed.

Yes, under the revised fixed rate or actual method. We’ll guide you based on your situation.

Not at all. We handle everything online or over the phone for your convenience.

Generally yes — we know how to maximise deductions and avoid errors that trigger ATO delays.

Didn’t find what you’re looking for?

Ready to Lodge Your Tax Return?

We make lodging your tax return simple, fast, and stress-free.

| Rental Property Tax Returns in Melton

Property Tax Filing

Do you own one or more investment properties in Melton or across Australia? At RBizz Corporate Accountants, we specialise in preparing rental property tax returns in Melton for individual investors, couples, family trusts, and SMSFs. Whether you're a first-time landlord or a seasoned investor with a growing property portfolio, our expert tax accountants in Melton ensure that your rental income and deductions are accurately reported and ATO-compliant.

Access our free tools, tips, blogs, and videos to grow your business smarter.

RBizz – Your Trusted Tax Partner in Melton

ATO-Registered Experts

Work with experienced tax agents registered with the Australian Taxation Office for accuracy and peace of mind.

Fast Turnaround

We value your time — get your tax returns done quickly and efficiently, often within 24–48 hours.

Secure & Confidential

Your privacy is our priority. We ensure all personal data is handled with strict confidentiality and care.

Friendly, No-Jargon Advice

We speak your language and make tax time simple — no confusing terms, just helpful support.

| Key Information for Property Investors

If you receive rental income from residential or commercial properties, you must declare it in your annual tax return. You can also claim a range of deductions to reduce your taxable income, including:

Common Income to Declare:

•Rent received

•Insurance payouts

•Bond money retained

•Reimbursement of expenses

Common Deductions:

•Loan interest

•Property management fees

•Repairs and maintenance

•Council rates and water charges

•Depreciation of building and assets

•Travel expenses (for inspections – limited after 1 July 2017)

•Land tax, insurance, and body corporate fees

Our Process – Rental Property Tax Return

Free Initial Consultation

Phone, Zoom, or face-to-face

Document Collection

We guide you on what to provide: loan statements, rent summaries, receipts, depreciation reports

Review & Analysis

We ensure all eligible deductions are identified

Tax Return Preparation

Prepared by our senior accountants

Lodgement & Follow-up

We lodge it with the ATO and monitor for notices or audits

Ongoing Support

Year-round access for queries or tax planning

Typical turnaround: 2–4 business days (depending on information availability)

How to Reduce Tax on Your Rental Property

| Claim interest on your loan – but only the portion used for income-producing purposes |

| Get a quantity surveyor’s depreciation report (especially for new or renovated properties) |

| Prepay interest or insurance for 12 months before 30 June |

| Keep detailed receipts – don’t rely only on bank statements |

| Use a trust or SMSF structure if aligned with your long-term goals |

| Consider capital works deductions (up to 2.5% p.a. of eligible construction costs) |

Discover More About Rental Property Tax Returns in Melton

Yes, but it depends on when the property was acquired and whether you bought new or second-hand. You may still be able to claim capital works deductions even for older properties.

Yes. If you receive Airbnb or room rent, it's assessable income. You can claim partial expenses, but CGT implications may apply when you sell.

You’ll need:

- Property settlement statement

- Annual rent summary from your agent

- Loan interest statements

- Expense receipts

- Depreciation schedule (if available)

We provide a full checklist at the start of your engagement.

Absolutely. Many of our clients own 2–10+ properties and we handle their portfolios through company, trust, or SMSF structures.

Our pricing starts at $330 (incl. GST) for individual returns with one property, and scales based on complexity or additional structures (trusts/SMSFs).

Didn’t find what you’re looking for?

Ready to Lodge Your Tax Return?

We make lodging your tax return simple, fast, and stress-free.

|Sole Trader Tax Returns in Melton

Individual Business Tax

If you’re operating your business under your own ABN, you’re considered a sole trader, and your tax situation comes with unique responsibilities and opportunities. At RBizz Corporate Accountants, we offer expert assistance with sole trader tax returns in Melton to help you stay compliant with the ATO, maximise your deductions, and simplify your bookkeeping and BAS lodgements. As specialist tax accountants for sole traders in Melton, we work with tradies, consultants, freelancers, online sellers, and home-based businesses across a range of industries.

Access our free tools, tips, blogs, and videos to grow your business smarter.

RBizz – Your Trusted Tax Partner in Melton

ATO-Registered Experts

Work with experienced tax agents registered with the Australian Taxation Office for accuracy and peace of mind.

Fast Turnaround

We value your time — get your tax returns done quickly and efficiently, often within 24–48 hours.

Secure & Confidential

Your privacy is our priority. We ensure all personal data is handled with strict confidentiality and care.

Friendly, No-Jargon Advice

We speak your language and make tax time simple — no confusing terms, just helpful support.

What You Need to Know

If you earn any income under an ABN — even if part-time or casual — you must lodge an individual tax return that includes your business income and expenses.

Key Sole Trader Tax Responsibilities:

- Lodge an individual tax return with business schedule

- Report business income and allowable expenses

- Register and report GST (if turnover > $75,000)

- Lodge Business Activity Statements (BAS) if registered for GST

- Pay PAYG instalments (if required by ATO)

- Keep proper bookkeeping records for at least 5 years.

Our Process – Sole Trader Tax Return

Upgrade to one of our monthly packages for fixed fees and peace of mind.

Tax-Saving Tips for Sole Traders

As experienced business tax accountants in Melton, we help sole traders reduce tax legally through:

Discover More About Sole Trader Tax Returns in Melton

Sole trader income is added to your individual tax return and taxed at marginal rates. You don’t pay company tax but can reduce tax via deductions and super.

Yes, if your annual turnover exceeds $75,000, you must register and lodge BAS. We can set this up for you.

You'll need:

- Sales or income reports (from Xero, Excel, or bank statements)

- Invoices and receipts for expenses

- Motor vehicle and home office usage details

- Previous tax return (if new to RBizz)

We offer a handy checklist to all clients.

Yes, but sole traders often miss deductions or misreport GST, leading to audits. Using a registered tax agent ensures accuracy, ATO compliance, and better outcomes.

Our sole trader tax return service starts from $440 (incl. GST) and may include BAS lodgements, bookkeeping catch-up, and business advice depending on your needs.

Didn’t find what you’re looking for?

Ready to Lodge Your Tax Return?

We make lodging your tax return simple, fast, and stress-free.

|Company Tax Returns in Melton

Business Tax Compliance

At RBizz Corporate Accountants, we specialise in preparing and lodging accurate, compliant and strategic company tax returns in Melton. Whether you're a startup, a small business company, or a growing enterprise with international dealings, we ensure your company’s tax obligations are handled with precision and foresight.

Our experienced corporate tax accountants in Melton offer more than just lodgements — we provide strategic tax planning, structure advice, and ongoing support to help you stay compliant and tax-efficient.

Access our free tools, tips, blogs, and videos to grow your business smarter.

RBizz – Your Trusted Tax Partner in Melton

ATO-Registered Experts

Work with experienced tax agents registered with the Australian Taxation Office for accuracy and peace of mind.

Fast Turnaround

We value your time — get your tax returns done quickly and efficiently, often within 24–48 hours.

Secure & Confidential

Your privacy is our priority. We ensure all personal data is handled with strict confidentiality and care.

Friendly, No-Jargon Advice

We speak your language and make tax time simple — no confusing terms, just helpful support.

What You Need to Know

All companies registered with ASIC and carrying on business in Australia (even if dormant or not trading) must lodge an annual company tax return with the ATO.annual company tax return with the ATO.

What’s included in a company tax return?

| Gross income (sales, interest, dividends, foreign income) |

| Business expenses and deductions |

| Depreciation (temporary full expensing if eligible) |

| Director/shareholder drawings |

| Loans, inter-entity transactions, and trust distributions |

| Imputation/franking credits |

Key Obligations

| Lodge company tax return (Form C) by due date |

| Maintain company financial records for 5+ years |

| Pay company tax at 25% (base rate entity) or 30% (standard) |

| Meet ASIC annual review and solvency declaration |

| Comply withDivision 7A (loans to shareholders/directors) |

| Prepare and issue franking account balances if paying dividends |

Our Process – Company Tax Return

We also lodge ASIC forms, manage your corporate compliance, and coordinate resident director services for overseas companies.

How to Reduce Company Tax Legally

Our company tax return service isn’t just about reporting — it’s about strategic tax efficiency. Here’s how we help reduce tax for companies:

Review and optimise your chart of accounts and expense classification

Maximise deductions (e.g. temporary full expensing before 30 June 2025)

Access R&D tax incentives or small business tax offsets

Restructure to trust-company hybrid models (if beneficial)

Allocate directors' salaries/dividends tax-effectively

Prepay expenses or defer income where applicable

Optimise super contributions and director benefits

Apply Division 7A loan compliance to avoid unfranked dividends

Consider loss carry-back provisions (if eligible)

Discover More About Company Tax Returns in Melton

For the 2024–25 year:

• 25% for base rate entities (turnover < $50 million & passive income < 80%)

• 30% for all others

We determine and apply the correct rate for your company.

Yes, even non-trading companies must lodge a return or submit a “Return Not Necessary” declaration. We handle both.

Yes, director or employee wages paid from the company (with PAYG withheld and super paid) are generally deductible business expenses.

Yes, provided you meet the continuity of ownership or same business test. We help track and apply losses year to year.

Our fees start from $660 incl. GST for basic trading companies. Packages are customised based on your business complexity, bookkeeping condition, and volume of transactions.

Didn’t find what you’re looking for?

Ready to Lodge Your Tax Return?

We make lodging your tax return simple, fast, and stress-free.

| Partnership Tax Returns in Melton

Maximise Deductions, Minimise Stress

Filing a partnership tax return in Australia requires careful attention to detail and compliance with the Australian Taxation Office (ATO). Each partnership must lodge a Partnership Tax Return (Form P) annually to report income, deductions, and net income or loss. While the partnership itself doesn’t pay tax, each partner must declare their share of income in their individual or entity return. It's essential to keep accurate financial records and comply with all tax obligations. Our expert tax accountants can help partnerships ensure ATO compliance, identify tax-saving opportunities, and avoid penalties. Trust us to make your tax reporting stress-free.

Access our free tools, tips, blogs, and videos to grow your business smarter.

RBizz – Your Trusted Tax Partner in Melton

ATO-Registered Experts

Work with experienced tax agents registered with the Australian Taxation Office for accuracy and peace of mind.

Fast Turnaround

We value your time — get your tax returns done quickly and efficiently, often within 24–48 hours.

Secure & Confidential

Your privacy is our priority. We ensure all personal data is handled with strict confidentiality and care.

Friendly, No-Jargon Advice

We speak your language and make tax time simple — no confusing terms, just helpful support.

What You Need to Know

A partnership must lodge a Partnership Tax Return (Form P) every financial year.

The partnership itself is not taxed, but each partner is taxed on their share of the net income.

You need a Tax File Number (TFN) for the partnership.

Accurate bookkeeping is essential for income, expenses, and distributions.

Partners must also report their individual income tax return including partnership income or loss.

Our Process – Partnership Tax Return

Gather Financial Records

Collect all income, expense, and capital records for the year.

Prepare Financial Statements

Generate a profit and loss statement and balance sheet.

Allocate Income/Loss

Distribute net income or loss between partners according to the partnership agreement.

Complete the Partnership Return (Form P)

Report all relevant details including ABN and TFN.

Lodge with the ATO

Submit the return online via a registered tax agent or ATO portal.

Each Partner Lodges Their Own Return

Include their share of partnership income.

Our process ensures a smooth partnership tax return—from gathering financial records and preparing statements, to allocating income, completing Form P, lodging with the ATO, and ensuring each partner files their own return accurately.

How to Reduce Tax on Your Partnership Legally

Use instant asset write-offs for eligible equipment purchases.

Claim deductions for operating expenses like rent, salaries, and utilities.

Split income effectively according to your partnership agreement.

Make super contributions for partners and claim deductions where allowed.

Consider restructuring or using small business tax concessions.

Keep meticulous records to substantiate deductions and avoid audits.

Discover More About Partnership Tax Returns in Melton

No. A partnership doesn’t pay income tax. Each partner is taxed individually on their share.

Yes. A TFN is required to lodge the Partnership Tax Return.

Losses are divided among partners and reported in their individual tax returns, subject to rules.

Yes, but it’s advisable to use a registered tax agent for accuracy and compliance.

The ATO may impose penalties and interest, and it may affect each partner's personal tax.

Didn’t find what you’re looking for?

Ready to Lodge Your Tax Return?

We make lodging your tax return simple, fast, and stress-free.

| Trust Tax Returns in Melton

Compliant, Strategic & Tax-Effective

At RBizz Corporate Accountants, we provide expert assistance with trust tax returns in Melton for a wide range of trust structures including family trusts, discretionary trusts, unit trusts, hybrid trusts, fixed trusts, and testamentary trusts. Whether your trust holds a business, investment portfolio, real estate, or receives distributions, our team ensures accurate preparation, optimal distribution strategy, and full ATO compliance.

Access our free tools, tips, blogs, and videos to grow your business smarter.

RBizz – Your Trusted Tax Partner in Melton

ATO-Registered Experts

Work with experienced tax agents registered with the Australian Taxation Office for accuracy and peace of mind.

Fast Turnaround

We value your time — get your tax returns done quickly and efficiently, often within 24–48 hours.

Secure & Confidential

Your privacy is our priority. We ensure all personal data is handled with strict confidentiality and care.

Friendly, No-Jargon Advice

We speak your language and make tax time simple — no confusing terms, just helpful support.

Who must lodge a trust tax return?

All trusts that derive income or have activity during the year must lodge a Trust Tax Return (Form T) annually with the ATO, even if all income is distributed to beneficiaries.

Our Process - Trust Tax Return

Trusts with a tax agent (like RBizz) benefit from extended lodgement deadlines – often up to 15 May the following year.

How to Reduce Tax in Trusts (Legally)

Our trust tax accountants in Melton help clients reduce tax with smart strategies such as:

•Distribute income to lower-income family members (within

legal limits)

•Use testamentary trusts for minor beneficiaries (taxed as adults)

•Split income between individuals, companies, and SMSFs

where allowed

•Claim full deductions (interest, depreciation, property

expenses, management fees)

•Ensure trustee resolutions are made before 30 June

•Use bucket company structures to cap tax at 25%

•Maximise franking credit benefits from dividend income

-Offset capital gains with carried-forward capital losses

Discover More About Trust Tax Returns in Melton

Yes, but only if the company is a beneficiary named in the deed. SMSFs must meet strict SIS compliance. We’ll review your deed and structure accordingly.

Generally, the trust itself is not taxed (except in special cases like non-resident or undistributed income). Income is distributed and taxed in the hands of beneficiaries.

The trustee may be assessed at the top marginal tax rate (currently 47%). That’s why we plan and draft resolutions ahead of time for all clients.

Yes, but conditions apply. Special rules such as the pattern of distributions test or income injection test must be met. We review eligibility each year.

Our fees start from $660 incl. GST for standard trusts and vary depending on the number of beneficiaries, asset types, and business activity. We provide fixed-fee quotes upfront.

Didn’t find what you’re looking for?

Ready to Lodge Your Tax Return?

We make lodging your tax return simple, fast, and stress-free.

| SMSF Tax Returns & Audit in Melton

Accurate, Compliant & Independent

Managing your own superannuation fund comes with control—but also strict responsibility. At RBizz Corporate Accountants, we provide complete support for preparing and lodging SMSF tax returns in Melton, and coordinating independent SMSF audits to ensure full compliance with ATO and SIS legislation.

Whether you’re an experienced trustee or have just set up a self-managed super fund, our team of SMSF specialists help you stay on top of your tax, reporting, and lodgement requirements with confidence.

Access our free tools, tips, blogs, and videos to grow your business smarter.

What is an SMSF tax return?

Each SMSF must lodge an annual return (SAR) with the ATO that includes:

•Financial statements (balance sheet, income statement)

•Member contributions and balances

•Investment income (interest, dividends, capital gains)

•Expenses and deductions

•Compliance declarations

•Details of any in-house assets or related-party transactions

Audit Requirement

Every SMSF must also be independently audited each year before the annual return is lodged. The audit covers:

| Financial compliance |

| Regulatory compliance with SIS Act |

| Breaches (e.g. loans to members, exceeding contribution caps) must be reported. |

We work closely with trusted independent SMSF auditors (who are not part of our team) to ensure arm’s length compliance, while managing all the documentation on your behalf.

Our Process - SMSF Tax Return & Audit

Initial Review

Fund deed, trustee structure, prior year returns.

Document Collection

Bank statements, investment reports, contribution records.

Financials Preparation

Balance sheet, member statements, income/expenditure.

SAR Preparation

Completed by our SMSF tax specialists.

SMSF Audit

Lodged with a third-party independent SMSF auditor.

ATO Lodgement

Timely submission and post-lodgement support.

Ongoing SMSF Advice

Contribution limits, investment rules, trustee duties.

Lodgement deadlines extend to 15 May if managed by a registered tax agent like RBizz.

How to Minimise Tax in Your SMSF

As specialist SMSF tax agents in Melton, we help trustees optimise outcomes with smart, compliant strategies:

We help you unlock value, minimise tax, and reduce transaction risk.

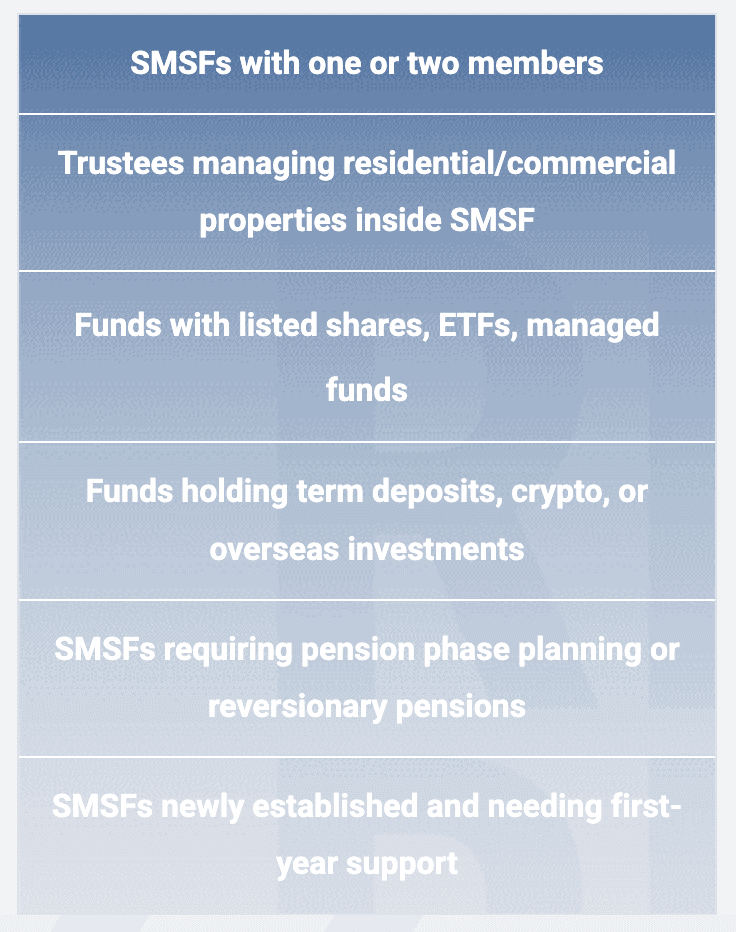

Who We Help

Discover More About SMSF Tax Returns in Melton

Generally, 15% on investment income, and 0% in pension phase (subject to Transfer Balance Cap). Penalty tax applies if the fund is non-compliant.

We prepare your SMSF return, but the audit must be completed by an independent registered SMSF auditor, separate from our team. We manage this entire process for you.

Late lodgement can result in:

- Administrative penalties

- Suspension or removal from the ATO's SMSF lodgement program

- Trustee disqualification in severe cases

Yes – provided they relate to running the fund and not personal financial advice. We ensure correct allocation for tax and reporting.

Our SMSF service starts at $880 incl. GST, including return preparation, financials, coordination of independent audit, and ATO lodgement. Fees vary based on asset types and transaction complexity.

Didn’t find what you’re looking for?

Ready to Lodge Your Tax Return?

We make lodging your tax return simple, fast, and stress-free.

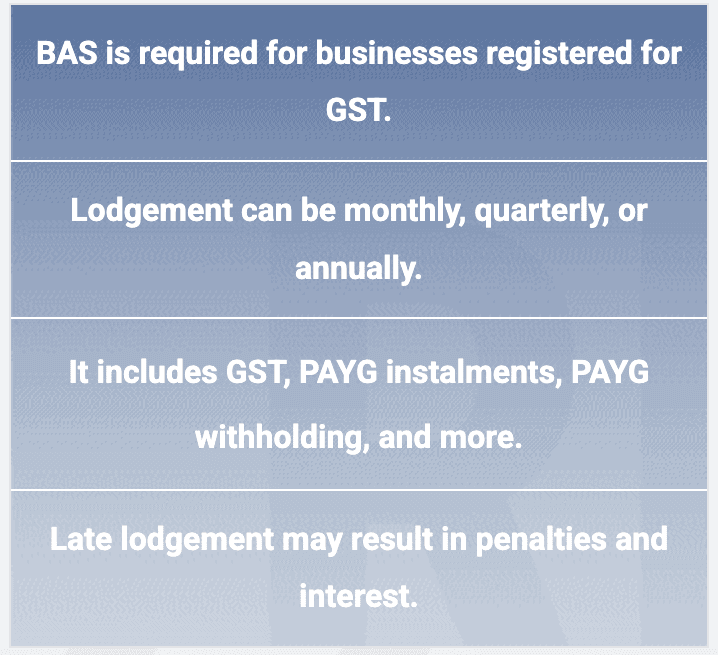

| Business Activity Statements (BAS) in Melton

Track. Report. Comply.

Access our free tools, tips, blogs, and videos to grow your business smarter.

RBizz – Your Trusted Tax Partner in Melton

ATO-Registered Experts

Work with experienced tax agents registered with the Australian Taxation Office for accuracy and peace of mind.

Fast Turnaround

We value your time — get your tax returns done quickly and efficiently, often within 24–48 hours.

Secure & Confidential

Your privacy is our priority. We ensure all personal data is handled with strict confidentiality and care.

Friendly, No-Jargon Advice

We speak your language and make tax time simple — no confusing terms, just helpful support.

What You Need to Know

Our Process - Business Activity Statements (BAS)

Initial Consultation

Understand your business and GST status.

Bookkeeping Review

Ensure records are accurate and up to date.

BAS Calculation

Identify GST credits, liabilities, and PAYG.

ATO Lodgement

Lodge BAS on time through secure portals.

Discover More About Business Activity Statements (BAS) in Melton

Usually quarterly on the 28th of the following month, or monthly if required.

Only those registered for GST.

You may incur penalties or interest charges from the ATO.

Yes, you can revise it using a revision form or the next BAS cycle.

Yes, we are registered agents and can lodge it securely.

Didn’t find what you’re looking for?

Ready to Lodge Your Tax Return?

We make lodging your tax return simple, fast, and stress-free.

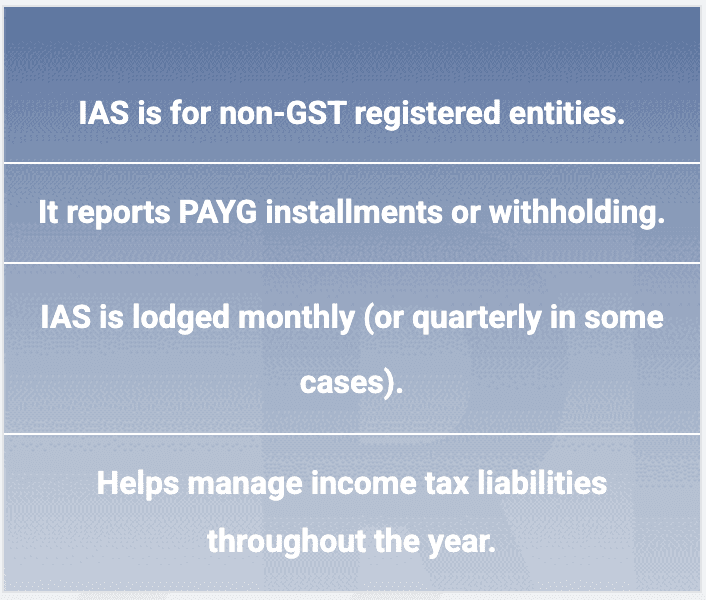

|Instalment Activity Statements (IAS) in Melton

Pay. Plan. Prepare.

Access our free tools, tips, blogs, and videos to grow your business smarter.

RBizz – Your Trusted Tax Partner in Melton

ATO-Registered Experts

Work with experienced tax agents registered with the Australian Taxation Office for accuracy and peace of mind.

Fast Turnaround

We value your time — get your tax returns done quickly and efficiently, often within 24–48 hours.

Secure & Confidential

Your privacy is our priority. We ensure all personal data is handled with strict confidentiality and care.

Friendly, No-Jargon Advice

We speak your language and make tax time simple — no confusing terms, just helpful support.

What You Need to Know

Our Process - Installment Activity Statements (IAS)

Eligibility Check

Confirm if you need to lodge an IAS.

Data Collection

Review payroll or income records.

Instalment Calculation

Determine correct PAYG amounts.

ATO Submission

Lodge securely and track confirmation.

Discover More About Installment Activity Statements (IAS) in Melton

Individuals/businesses not registered for GST but required to report PAYG.

Usually monthly, as directed by the ATO.

Yes, through myGov or a registered tax agent.

BAS includes GST and other taxes; IAS is mainly for PAYG.

You can revise it or correct it in the next IAS period.

Didn’t find what you’re looking for?

Ready to Lodge Your Tax Return?

We make lodging your tax return simple, fast, and stress-free.

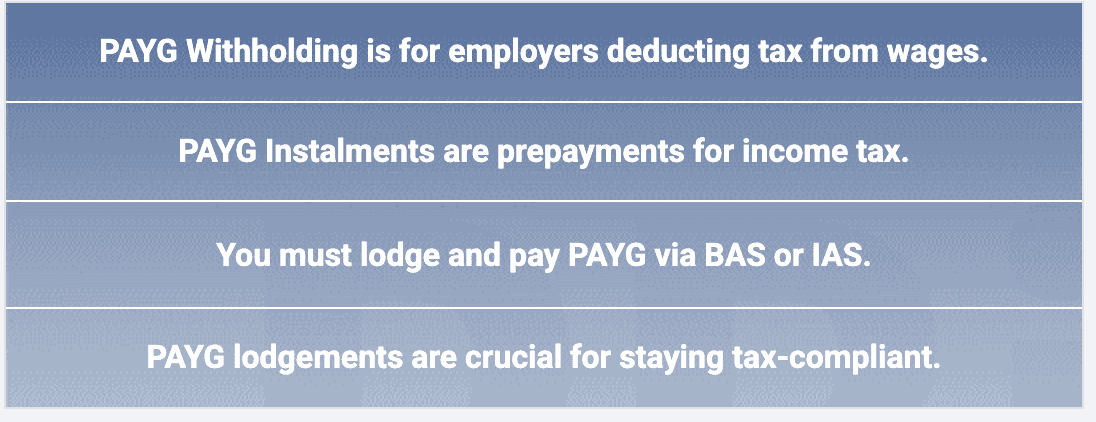

| PAYG Lodgements in Melton

Withhold. Report. Comply.

Access our free tools, tips, blogs, and videos to grow your business smarter.

| Explore More BAS Insights

Watch Our Service Overview on YouTube

What You Need to Know

Our Process - PAYG Lodgements

Client Assessment

Understand your business type and PAYG status.

Record Review

Audit wages or income data.

Tax Calculation

Calculate PAYG obligations accurately.

ATO Lodgement

Submit securely and confirm compliance.

Discover More About PAYG Lodgements in Melton

Tax withheld from employee wages by employers.

Tax prepayments based on your business/income projections.

Alongside BAS or via IAS, depending on registration.

Yes, you can vary them if your income fluctuates.

Yes, if you're required by the ATO based on income or wages.

Didn’t find what you’re looking for?

Ready to Lodge Your Tax Return?

We make lodging your tax return simple, fast, and stress-free.

Tax Planning & Advisory

Strategic tax planning beyond compliance to optimize your business and personal finances in Melton. We tailor solutions for business restructuring, trusts, SMSFs, and salary packaging to minimize tax liabilities and maximize wealth.

Maximize savings and protect your assets with expert tax planning tailored for your unique needs.

What We Offer:

Business Restructuring

Optimize your structure for tax efficiency and future growth opportunities.

Family Trust & SMSF Strategies

Protect and grow your wealth with smart trust and self-managed super fund planning.

Capital Gains Tax Planning

Manage asset sales to reduce CGT impact and preserve your capital.

Division 7A & Loan Structuring

Navigate complex loan rules to avoid unexpected tax penalties.

Tax-Effective Salary Packaging

Maximize take-home pay with tailored salary packaging solutions.

Why It Matters?

Effective tax planning helps you keep more of your hard-earned money while ensuring compliance with complex regulations. By proactively managing your tax strategy, you can reduce risks, enhance cash flow, and secure a stronger financial future.

GST and BAS Compliance

Comprehensive GST and BAS compliance services to keep your business on track and audit-ready. We handle accurate reporting, input credits, and timely lodgements, so you never miss a deadline.

Stay compliant and stress-free with expert GST and BAS management tailored to your business needs.

What We Offer:

Accurate GST Reporting

Ensure correct classification and calculation of GST to avoid costly errors.

Timely BAS Lodgement

Meet monthly, quarterly, or annual deadlines without the stress.

Input Credit Management

Maximise your GST credits with thorough invoice reviews and documentation.

Compliance Assurance

Reduce risk with up-to-date compliance aligned to ATO regulations.

Why It Matters?

Proper GST and BAS management safeguards your business from penalties and audits. Timely and accurate lodgements ensure cash flow stability and maintain your good standing with the ATO.

International Taxation

Navigate the complexities of international tax with expert advice on cross-border income, treaties, and compliance. We help you minimize double taxation and meet global reporting obligations.

Operating overseas or receiving income from abroad? Our international tax specialists assist with:

Double Tax Agreements

Withholding tax

Transfer pricing

Foreign income disclosures

Why It Matters?

International taxation is complex but critical to avoid costly penalties and double taxation. Proper guidance ensures your global operations remain compliant while optimizing your tax position worldwide.

Estate and Trust Taxation

Expert tax guidance for trusts and estates, helping you manage compliance and optimize tax outcomes. We specialise in family, discretionary, and testamentary trusts as well as deceased estates.

We provide expert guidance on the taxation of:

Discretionary Trusts |

Family Trust |

Testamentary Trusts |

Deceased Estates and Capital Distributions |

We also assist with Family Trust elections and streaming resolutions for tax efficiency.

Why It Matters?

Trust and estate taxation is complex but crucial for protecting family wealth and ensuring fair distribution. Expert advice helps minimise tax liabilities and avoid costly compliance errors.

Transfer Pricing Support

Comprehensive transfer pricing support for multinational businesses to ensure compliance and reduce audit risks. We help with documentation, method selection, and aligning with ATO requirements.

What We Offer:

Transfer Pricing Documentation

Prepare detailed reports that meet ATO standards and regulations.

Method Selection

Identify the most appropriate transfer pricing methods for your transactions.

Compliance Management

Ensure ongoing adherence to regulatory requirements and reduce risks.

Audit Risk Reduction

Proactively manage transfer pricing to minimise the chance of costly audits.

Minimise audit risk and ensure fair pricing between related entities with expert transfer pricing support.

Why It Matters?

Proper transfer pricing management is essential for multinational entities to avoid penalties and costly audits. Expert support ensures your pricing policies are compliant and defensible under ATO scrutiny.

Who We Help in Melton

Our taxation services in Melton are designed for:

Discover More About Taxation Services in Melton

A tax agent is registered with the Tax Practitioners Board and legally allowed to lodge returns and represent clients with the ATO. A tax accountant may prepare returns, but only a registered agent can lodge on your behalf.

🔗 Check if a provider is registered: TPB Register

You’ll need:

• Business Activity Statement (BAS) lodgements

• Annual business tax return

• PAYG withholding and instalment reporting

• Tax planning before year-end

Our small business tax accountants manage all of the above under one plan.

Yes. We assist clients with:

• Multiple year tax return backlogs

• Payment arrangement negotiations

• ATO objections or reviews

• Director penalty notices (DPNs)

Absolutely. Through:

• Business restructuring

• Reviewing asset purchases (depreciation planning)

• Super contributions

• Trust distributions

• Fringe benefits planning

We aim to legally minimise tax and protect your wealth.

We offer transparent, fixed-fee pricing. Tax return packages start from:

• $220 for individuals

• $330+ for sole traders

• $550+ for companies/trusts

Custom quotes are provided after a free consultation.

Didn’t find what you’re looking for?

Ready to Lodge Your Tax Return?

We make lodging your tax return simple, fast, and stress-free.

Business Advisory & Strategy in Melton

Grow smarter with structured advice tailored to Officer-based businesses.

At RBizz Corporate Accountants, we provide end-to-end business advisory services in Officer that empower local entrepreneurs, SMEs, family businesses, and growing enterprises to achieve structured, scalable growth.

Whether you're starting a business, navigating a competitive market, preparing for sale, or restructuring for efficiency, our experienced business advisors in Officer guide you with data-driven strategy, financial insight, and regulatory alignment. As Chartered Accountants, we go beyond compliance — we provide clarity and control to support better decisions.

| Business Advisory & Strategy We Offer

Select a service to see how we can help

Explore Our Services in Action

Watch Our Service Overview on YouTube

Access our free tools, tips, blogs, and videos to grow your business smarter.

Why RBizz is the Business Advisory and Strategy Partner in Melton

RBizz brings clarity, confidence, and strategic insight — the partner your business needs to thrive.

Strategic Business Planning

We work closely with business owners and directors to design short- and long-term strategic plans, ensuring clarity in direction, goals, and performance metrics. Includes:

Vision and goal setting

Market Positioning and SWOT Analysis

Operational Roadmaps and KPIs

Growth and Exit Strategy Formulation

A strategic business plan is often a prerequisite for raising capital or seeking government grants.

Why It Matters?

A solid business strategy brings clarity, accountability, and direction to your operations. It’s also essential for raising capital, attracting investors, or qualifying for government grants.

Business Valuation Services

Whether you’re buying, selling, onboarding investors, or reorganising, we provide professional business valuations using recognised industry methods:

Capitalisation of Earnings (CoE)

Discounted Cash Flow (DCF)

Market Multiple Comparisons

Asset-Based Valuation

Why It Matters?

Knowing your business’s value is essential for strategic decisions like selling, acquiring, or attracting investors. A professional valuation provides confidence and clarity in negotiations and future planning.

Risk Management & Internal Controls

We help protect your business by identifying financial and operational risks and implementing tailored strategies to reduce vulnerabilities and ensure continuity.

Secure your business with proactive risk management and strong internal controls that drive resilience.

We identify financial and operational risks and develop practical mitigation strategies, including:

| Internal Control Reviews |

| Fraud Risk Assessment |

| Business Continuity Planning |

| Compliance Audits and Policy Frameworks |

Tailored for Officer-based businesses expanding into new markets or increasing headcount.

Why It Matters?

Effective risk management protects your assets, reputation, and operational stability. Strong internal controls ensure compliance, reduce fraud, and build long-term business resilience.

Corporate Structuring & Restructuring

We design efficient and tax-effective structures for:

Our structuring expertise includes discretionary trusts, unit trusts, bucket companies, hybrid entities, and holding company arrangements.

Asset Protection

Shield personal and business assets with secure legal structures.

Succession Planning

Plan smooth leadership transitions and future-proof your business legacy.

Joint Ventures

Structure collaborative partnerships with clarity and tax efficiency.

Business Reorganisation

Restructure entities to improve operational, legal, and tax outcomes.

Why It Matters?

The right corporate structure protects your interests and unlocks tax advantages. Whether launching, expanding, or reorganising, strategic structuring ensures your business is built to last.

Mergers & Acquisitions (M&A)

Whether buying or selling a business in Melton, we provide end-to-end M&A support — from due diligence to integration — ensuring value, compliance, and minimal risk.

Thinking of acquiring a business in Officer or preparing to sell? We offer:

Due Diligence Reviews

Identify financial, legal, and operational risks before you commit to a deal.

Deal Structuring

Design transactions to be tax-effective, legally sound, and strategically aligned.

Financial Modelling

Assess future performance and scenario planning to guide decision-making.

Integration Planning

Ensure a smooth post-deal transition across people, systems, and operations.

Capital Raising Support

Access funding through equity, debt, or investor networks to fuel your M&A goals.

We help you unlock value, minimise tax, and reduce transaction risk.

Why It Matters?

M&A transactions are high-stakes and complex — expert guidance ensures you're making strategic, well-informed decisions. From risk mitigation to value creation, we support your success every step of the way.

Who We Help

Our business advisory clients in Officer include:

Discover More About Business Advisory in Melton

A traditional accountant focuses on compliance (lodging returns), while a business advisor offers strategic insights on growth, performance, risk, and profitability.

At RBizz, we provide both.

Yes. We develop professional-grade business plans tailored for loan applications, funding rounds, and grant programs.

This includes financial forecasting and strategic analysis.

Our advisory services start at $330/hr, or we can offer fixed-fee projects depending on your needs.

Strategic planning packages typically start from $2,200+GST.

We support both. Our startup advisory service includes structuring, registrations, financial modelling, and cash flow forecasting.

Yes. Many of our clients opt for ongoing support through our Virtual CFO services,

which include advisory, reporting, tax, and compliance as a bundled package.

Didn’t find what you’re looking for?

Boost Your Business with the Right Advice

Smart strategies. Real growth.

Virtual CFO Services in Melton

CFO expertise without full-time hiring. Especially suited for growing companies.

RBizz Corporate Accountants offers Virtual CFO Services in Officer designed for growing businesses that need high-level financial strategy and reporting — without the cost of hiring a full-time CFO. As experienced outsourced CFOs in Officer, we work with startups, SMEs, family businesses, and subsidiaries of overseas companies to drive financial clarity, control, and commercial success.

Our part-time CFO services are flexible, scalable, and backed by Chartered Accountants who understand compliance, cash flow, capital raising, and risk.

| Virtual Services We Offer

Select a service to see how we can help

Interim or Fractional CFO Support

Expert guidance without full-time cost.

Capital Raising & Investor Readiness

Prepare. Pitch. Secure funding.

Financial Strategy & Planning

Plan for growth and sustainability.

Financial Reporting & Compliance

Stay transparent and compliant.

Cost Control and Efficiency

Reduce waste. Maximise profits.

M&A, Due Diligence, and Exit Readiness

Prepare for smooth transitions.

| Explore Our Services in Action

Watch Our Service Overview on YouTube

Access our free tools, tips, blogs, and videos to grow your business smarter.

Why Trust RBizz for Virtual CFO Services

With RBizz as your Virtual CFO, you gain a trusted financial partner focused on your success at every stage.

What Is a Virtual CFO?

A Virtual CFO (Chief Financial Officer) is an outsourced finance expert who provides strategic guidance, reporting, and oversight — much like an in-house CFO — but on a contract, fractional, or part-time basis.

At RBizz, our Virtual CFO services help you:

Understand your financial performance |

Meet reporting and compliance deadlines |

Raise capital and manage investor relations |

Forecast cash flow and plan for growth |

Control costs and optimise profitability |

Navigate audits, funding rounds, and acquisitions |

Interim or Fractional CFO Support

RBizz Solutions provides part-time CFO expertise for strategic guidance, reporting, and transition support.

Monthly or quarterly CFO engagement

Board-level financial insight and reporting

Support during leadership transition, funding, or restructuring

Why It Matters?

An interim or fractional CFO brings expert financial leadership when you need it most — without long-term commitment. This support is essential during growth, restructuring, capital raising, or leadership transitions.

Capital Raising & Investor Readiness

Whether you’re buying, selling, onboarding investors, or reorganising, we provide professional business valuations using recognised industry methods:

Financial modelling and pitch support

Preparing investor decks and due diligence packs

Support for equity, debt, or grant funding rounds

Why It Matters?

Raising capital is more than pitching — it’s about presenting a credible, investable business. With expert preparation, you increase your chances of securing the right funding at the right time.

Financial Strategy & Planning

Whether you’re buying, selling, onboarding investors, or reorganising, we provide professional business valuations using recognised industry methods:

Strategic business goal alignment

Short- and long-term cash flow forecasts

Budgeting and scenario planning

Break-even and margin analysis

Why It Matters?

Strong financial strategy connects your business goals to measurable, achievable outcomes. With clear forecasts and analysis, you gain the confidence to scale, invest, and adapt wisely.

Financial Reporting & Compliance

We deliver timely monthly or quarterly financial reports, tailored board reporting packs with performance dashboards, and in-depth reviews of key performance indicators (KPIs), financial health, and risk exposure to ensure your business stays compliant and financially sound.

Monthly & Quarterly Reports

Stay on top of your numbers with regular, accurate financial statements.

Board Reporting Packs

Get presentation-ready reports with dashboards, commentary, and analysis.

KPI & Performance Review

Track financial health and performance against key strategic metrics.

Risk & Compliance Monitoring

Identify and address financial risks to maintain stability.

Why It Matters?

Accurate financial reporting is essential for compliance and strategic decision-making. Regular insights into KPIs and risks empower you to act early and grow sustainably.

Cost Control & Risk Management

Delivering clear, timely financial reports and dashboards to track performance, monitor KPIs, and ensure regulatory compliance.

Vendor Contract Reviews

Analyze and optimize supplier agreements to reduce costs and improve terms.

Cost-centre analysis and overhead management

Identify high-cost areas and streamline operations to boost efficiency and profitability.

Risk mitigation and process controls

Implement safeguards and internal controls to reduce business risks and ensure compliance.

Why It Matters?

Uncontrolled costs and unmanaged risks can quickly erode business profitability. A proactive approach ensures long-term sustainability and confidence in your operations.

M&A, Due Diligence, and Exit Readiness

Expert support for acquisitions, business sales, and smooth post-deal transitions.

Business sale or acquisition strategy

Buy-side and sell-side due diligence

Post-deal integration planning

Why It Matters?

A well-executed M&A or exit strategy can unlock significant value — but only with careful planning and execution. Our hands-on approach ensures you're ready at every stage, from deal prep to integration.

Who Needs Virtual CFO Services in Officer?

Startups

in growth or funding stages

Family businesses

scaling operations

SMEs

without internal finance leadership

Franchises and multi-location businesses

Foreign-owned subsidiaries needing local CFO presence

Companies preparing for IPO, acquisition, or restructure

Discover More About Virtual CFO Services in Melton

A bookkeeper handles transaction entry, and an accountant manages compliance. A Virtual CFO provides strategic, forward-looking financial advice, cash flow forecasting, performance reporting, and board-level insight.

Yes — especially for businesses turning over between $1M and $20M that need CFO expertise without a full-time salary commitment. Our service is modular and scalable.

We offer:

• Monthly CFO sessions

• Quarterly financial reviews

• Ad hoc strategy projects

We tailor engagement frequency based on your business needs and goals.

Absolutely. We often serve as the finance liaison between management, external accountants, legal advisors, and investors — ensuring unified communication and compliance.

Our Virtual CFO packages start from $990/month, depending on complexity and engagement frequency. Custom fixed-fee or project-based quotes are also available.

Didn’t find what you’re looking for?

Need Strategic Financial Guidance for Your Business?

Virtual expertise. Real results.

Statutory & Corporate Compliance in Melton

Stay Compliant, Stay Confident

Running a company in Australia comes with strict obligations under the Corporations Act 2001 (Cth). At RBizz Corporate Accountants, we provide comprehensive statutory and corporate compliance services in Melton to ensure your company stays compliant with ASIC, the ATO, and other regulatory bodies — year-round.

Our services are designed for company directors, secretaries, CFOs, foreign-owned subsidiaries, and SMEs who need expert help to manage increasingly complex reporting and corporate governance requirements.

| Statutory & Corporate Compliance We Offer

Select a service to see how we can help

ASIC Lodgements & Company Maintenance

Keep your business compliant and up to date.

Registered Office & Company Secretary

Professional support & legal address services.

Director Duties & Governance

Stay informed. Avoid penalties. Lead wisely.

ABN, GST & Business Name Compliance

Register, renew, and comply with ease.

Ongoing Compliance Monitoring

Get alerts. Never miss a deadline.

Alerts & Annual Reminders

Stay informed and proactive year-round.

| Explore Our Services in Action

Watch Our Service Overview on YouTube

Access our free tools, tips, blogs, and videos to grow your business smarter.

Why Trust RBizz for Statutory & Corporate Compliance in Melton

Trust RBizz to safeguard your business reputation and keep you fully compliant — so you can focus on growth, not red tape.

Why Statutory Compliance Matters

Failure to meet statutory obligations can result in:

ASIC penalties and late fees |

Deregistration of the company |

Director disqualification |

Reputational damage |

Loss of banking or trading access |

We act as your corporate compliance officer in Melton, providing proactive reminders, documentation, and filings to keep your company protected.

ASIC Lodgements & Company Maintenance

We prepare and lodge all ASIC compliance documents including:

•Annual company review

•Change of officeholders

•Change of company name, address, or share structure

•Share allotments, transfers, and cancellations

•Company deregistration or reinstatement

Why It Matters?

ASIC Lodgements & Company Maintenance matter because they ensure your business remains legally compliant, avoids penalties, and maintains its good standing with regulatory authorities.

Registered Office & Company Secretary Services

Registered office address service in Melbourne CBD

• Company secretary appointment (external officer)

• Maintaining corporate registers and minute books

• Issuing solvency resolutions and director declarations

All documents prepared in accordance with ASIC formatting and legal standards.

Why It Matters?

It ensures your company meets its legal obligations, maintains accurate records, and has a reliable point of contact for official communications with regulators like ASIC.

Director Duties & Corporate Governance

We help directors and officers understand their legal responsibilities under the Corporations Act, including:

| Duty of care and diligence |

| Duty to prevent insolvent trading |

| Conflict of interest management |

| Access to company records and financials |

| Meeting documentation and resolutions |

Why It Matters?

It ensures directors act responsibly, make informed decisions, and uphold legal and ethical standards, protecting the company and its stakeholders

from risk and liability.

ABN, GST & Business Name Compliance

Simplifying business registrations, renewals, and compliance for smooth operations across all entity structures.

ABN, TFN, and GST registration updates

Business name renewals and changes

Cancellation of inactive ABNs or businesses

Managing multiple entity structures under one group

Why It Matters?

Ongoing Compliance Monitoring & Alerts

Stay on top of critical deadlines and corporate updates with tailored calendars, timely alerts, and continuous support for legal and structural compliance.

Why It Matters?

Who We Help in Melton

We Support:

Discover More About Corporate Compliance in Melton

ASIC will charge late fees ($93 for 1–7 days late, $387 after that), and continued non-compliance can lead to company deregistration. We ensure you never miss a deadline.

Yes. We provide a registered address in Melbourne CBD, and can act as your outsourced company secretary, including minute taking, resolution preparation, and record keeping.

Directors must:

• Act in good faith

• Prevent insolvent trading

• Disclose conflicts of interest

• Maintain proper records

• Comply with ATO and ASIC obligations

We brief all directors annually on their duties and risks.

Absolutely. We offer group-level compliance packages for businesses operating multiple companies or trusts, ensuring all entities meet ASIC and ATO requirements efficiently.

• ASIC annual review support starts from $220/year

• Company secretary services from $550/year

• Full corporate compliance packages from $990/year

All pricing is fixed and transparent.

Didn’t find what you’re looking for?

Need help staying compliant with corporate regulations?

Simplify compliance and avoid penalties with expert support.

Payroll & HR Solutions in Melton

Accurate, Compliant & Fully Managed

Managing payroll and HR obligations can be time-consuming, error-prone, and legally complex. At RBizz Corporate Accountants, we provide reliable and fully compliant payroll and HR services in Melton, allowing businesses to focus on growth while we handle employee payments, compliance, and record-keeping.

Whether you employ 1 or 100+ staff, our payroll processing and HR advisory team supports you with ATO and Fair Work compliance, cost-effective administration, and peace of mind.

| Payroll & HR Solutions Services We Offer

Select a service to see how we can help

Payroll Processing

Accurate, timely payroll for your growing team.

Employee Onboarding & STP Setup

Smooth setup for new hires and Single Touch Payroll compliance.

HR Consulting & Advisory

Support for policies, procedures, and people strategy.

Compliance with Fair Work & ATO

Ensure your business meets all Fair Work and tax obligations.

| Explore More Payroll & HR Solutions Insights

Watch Our Service Overview on YouTube

Access our free tools, tips, blogs, and videos to grow your business smarter.

Why Trust RBizz for Payroll and HR Solutions in Melton

With RBizz, you get trusted payroll accuracy and HR expertise — giving you more time to lead your people and grow your business.

Payroll Processing

We offer end-to-end payroll services for small and medium businesses, including:

Why It Matters?

Employee Onboarding & STP Setup

Simplify hiring with digital onboarding, compliant contracts, and STP-ready payroll systems—ensuring smooth setup and adherence to Fair Work standards.

Why It Matters?

HR Consulting & Advisory

We provide tailored HR support to business owners and managers:

•HR policy development (code of conduct, leave policies, etc.)

•Employment contracts and position descriptions

•Award interpretation and

minimum wage guidance

•Disciplinary and termination procedures

•Casual conversion and entitlements advice

•HR documentation audits

Why It Matters?

Compliance with Fair Work & ATO

We help directors and officers understand their legal responsibilities under the Corporations Act, including:

Fair Work Award obligations

National Employment Standards (NES)

Superannuation guarantee rules

STP Phase 2 compliance

Leave entitlements and record-keeping requirements

Why It Matters?

Who Needs Payroll & HR Services in Melton?

Small and medium employers with growing teams

Franchisees and multi-site businesses

Medical and allied health clinics

Construction and trade services

Online and retail businesses

Startups and tech firms seeking scalable HR support

Whether you employ staff casually, permanently, or under contract, we can customise a plan that fits your compliance, systems, and growth needs.

Discover More About Payroll & HR Services in Melton

Yes. All employers must report payroll to the ATO via STP, even if you only have one employee. We ensure full STP compliance and provide real-time reporting support.

Absolutely. We guide you through every step — TFN, super choice, Fair Work documents, contracts, and STP setup. We’ll also ensure all awards are applied correctly.

We offer payroll reviews and back-pay calculations to rectify historical underpayments, misclassifications, or errors. We also help with voluntary disclosure to the ATO or Fair Work if needed.

Yes. Many of our clients bundle payroll, bookkeeping, and tax services. This ensures seamless data flow, reduced admin time, and better cash flow visibility.

Our packages start from $55 per pay run, with tailored pricing for monthly or bulk services. Fixed-fee packages are available for growing teams or ongoing HR support.

Didn’t find what you’re looking for?

Need stress-free payroll and HR management?

Stay compliant, pay accurately, and support your team with ease.

Business Setup & Registrations in Melton

Ideal for local entrepreneurs and foreign companies entering the Australian market.

Starting a new business in Australia can be exciting, but it also involves important legal and structural decisions. At RBizz Corporate Accountants, we provide expert business setup and registration services in Melton, ensuring that your new venture is built on a strong foundation. RBizz Corporate Accountants, we provide expert business setup and registration services in Melton, ensuring that your new venture is built on a strong foundation.

Whether you're starting as a sole trader, registering a Pty Ltd company, or setting up a trust, we simplify the process, handle the paperwork, and provide strategic advice to align your structure with your long-term goals.

| Business Setup & Registrations Services We Offer

Select a service to see how we can help

ABN, TFN & GST Registrations

Complete registration setup for businesses and individuals.

Pty Ltd Company Formation

Start your business with a proper legal structure.

Family, Unit & Hybrid Trust Setup

Tailored trust solutions for asset protection and planning.

Business Name Registration

Register and secure your business identity with ease.

Virtual Office & Mail Handling

Professional address and mail services for your business.

Business Plan & Market Strategy

Develop your roadmap and enter markets confidently.

| Explore Our Services in Action

Watch Our Service Overview on YouTube

Access our free tools, tips, blogs, and videos to grow your business smarter.

Why Trust RBizz for Business Setup & Registrations in Melton

Trust RBizz to make starting your business simple, strategic, and fully compliant — setting the foundation for future success.

ABN, TFN, and GST Registrations

We apply for all your business registrations with the ATO, including:

Australian Business Number (ABN)

Tax File Number (TFN)

Goods and Services Tax (GST)

PAYG Withholding & Fuel Tax Credits

Why It Matters?

Pty Ltd Company Formation

We handle all aspects of your company registration in Melton, including:

• ASIC company registration

• ACN, ABN, TFN setup

• Company constitution and shareholding

• Director and secretary appointments

• Registered office address in Melbourne CBD (if required)

Why It Matters?

Family Trust, Unit Trust, and Hybrid Trust Setup

We establish fully compliant discretionary (family) trusts, unit trusts, or hybrid trusts, including:

Why It Matters?

Choosing the right trust structure helps manage assets, distribute income tax-effectively, protect wealth, and plan for long-term succession and estate needs.

Business Name Registration

If you’re trading under a name other than your legal company or personal name, we can register your business name with ASIC and renew it when due.

Why It Matters?

Registering your business name ensures legal ownership, builds brand credibility, and allows you to operate and market your business officially across Australia.

Virtual Office & Mail Handling Services

Need a professional registered address for ASIC, ATO, or clients? We offer:

CBD-based virtual office services

Mail handling and forwarding

Use of address for ASIC/ATO registration purposes

Why It Matters?

Virtual Office & Mail Handling Services matter because they provide businesses with a professional presence, secure mail management, and operational flexibility—without the cost of a physical office.

Business Plan Development & Market Entry Strategy

We support startups and foreign companies entering Australia with:

•Professional business plans (bank/investor ready)

•Market entry feasibility and competitor analysis

• Structuring advice to reduce tax and increase asset protection

Why It Matters?

Business Plan Development & Market Entry Strategy matter because they lay the foundation for informed decision-making, attracting investors, and entering new markets with confidence and clarity.

Who We Help in Melton

Our business setup services are ideal for:

Discover More About Business Registration Services in Melton

ABN and TFN: 1 to 2 business days

Company registration: Usually same day

Trust setup: 2 to 3 business days

We handle everything quickly and keep you updated at every step.

It depends on your goals, risk exposure, and tax profile. We offer a free consultation to help choose the right business structure for your situation.

Yes, if your business expects to earn $75,000 or more annually, or if you're in certain industries (e.g. ride-sharing, taxi). We can register GST during setup.

Many family and investment trusts appoint a Pty Ltd company as trustee for greater asset protection and flexibility. We can establish the trustee company as part of the setup.

Absolutely. We support non-resident directors and foreign owners, offering local ASIC compliance, resident director services, and full virtual assistance.

Didn’t find what you’re looking for?

Starting a new business?

We’ll handle your registrations so you can focus on growing.

Resident Director & Local Representation in Melton

Trusted, Compliant & Professional